Menu

On April 23rd, 2024, the US Department of Labor (DOL) announced a finalized rule which will see the minimum compensation levels increasing for the ‘white collar’ exemptions to the federal Fair Labor Standards Act’s (FLSA) overtime premium pay requirements.

The rule will significantly increase the minimum salary threshold for those who work in an executive, professional, or administrative role (the so called ‘white collar’ exemptions). The threshold will increase across two dates; one on July 1st, 2024, and the other will follow on January 1st, 2025.

The current threshold for this exemption is $684 per week ($35,568 annually). This threshold will increase as follows:

- July 1st, 2024, the threshold will rise to $844 per week ($43,888 annually).

- January 1st, 2025, the threshold will rise to $1,128 per week ($58,656 annually).

In addition to this, this new rule also increases the minimum annualized salary threshold to qualify for the highly compensated employee (HCE) exemption. As it stands, the current threshold for HCE employees is $107,432 annually, but this will increase as follows:

- July 1st, 2024, the threshold will rise to $132,964 annually.

- January 1st, 2025, the threshold will rise to $151,164 annually.

Employees who meet the new minimum pay requirements must also meet all the other requirements of the FLSA exemptions in order to apply for one. For clarity, here are the criteria that need to be met alongside salary for each ‘white collar’ role:

Executive:

- The primary duties of the employee must relate to managing the business, or a department within the business.

- The employee must regularly manage at least two full-time employees, or the equivalent in part-time employees.

- The employee must have the authority to hire or fire employees, or the employee’s recommendations on hiring, firing, and promotions must carry significant weight.

Professional:

- The employee’s primary duties must relate to work that is largely intellectual and involves the regular use of “discretion and independent judgment” (defined by the DOL).

- The employee must work in a field of science or learning.

- The employee must have acquired his or her knowledge through a prolonged course of specialized intellectual instruction.

Administrative:

- The employee’s primary duties must be the performance of office or nonmanual work directly related to the management or general business operations of the company (or the general business operations of the company’s clients).

- The employee must regularly exercise discretion and independent judgment on important matters.

It is important for employers to be aware of these changes so to ensure that the employees who they are enrolling for exemption are still applicable against these new monetary criteria. This will either mean raising salaries to meet these new threshold increases, or formally reclassifying currently exempt employees and making them aware of their eligibility for overtime.

If you would like to discuss how we can help assist you with auditing your current payroll in anticipation of this change, as well as overseeing the management of this change, please get in touch with us.

This time of year, there are the usual surveys and articles about merit increases and executive pay increases.

For example, I saw a recent private company survey that said that more than 46% of organizations in the US plan to provide a more than 6% increase to the merit pool. Similarly, I have seen many articles commenting on the ‘astounding’ increases in executive pay.

However, you must be very wary of year over year comparisons, especially after a multi-year period where companies all took differing approaches to weathering the COVID hurricane. Because, as usual, there is no context given.

What is not said is: how many of the companies responding gave no increases during the pandemic; how many of those execs took significant pay cuts and no bonus during the pandemic; how many of those have just been restored to their pre-pandemic pay; how much of the pay ‘increase’ is really just due to rebounding stock value.

The practical reality is that there are several national surveys that have reached a general consensus on the merit pool increases being offered for 2023 – most have agreed this will be generally in the 4% range. While this materially lags the costs of living increases that employees have been experiencing, it is a focus on cost of labor, which is expected to increase by the 4% (it should be noted that merit pools have been at or above 3% for the last 4+ years despite inflation for several of those years being at 1% or less).

So when it comes to determining executive pay, we suggest you ignore the noise and focus on fundamentals. Are your salaries reasonable given the competitive market and the scope and complexity of your business? Is the bonus target and leverage appropriate? Are the metrics true drivers of value creation for stakeholders? Do your long-term incentives adequately align management with shareholders? Quality begins with these fundamentals, and if you can answer these questions in the affirmative, you do not need to pay attention to the media din around compensation.

But, if you find that you need assistance in answering these, then this is where we can help. With a range of long-term expertise in compensation strategy and pay philosophy, OrgShakers are able to help your company navigate the reality of executive pay increases so that it is a true reflection of the current economic context. To get in touch, either head over to our contact page or email me directly at chris@orgshakers.com

Most US-based publicly traded company boards will currently be approving 2021 executive incentives. As they do so, they will also be considering designs for their 2022 compensation programs. So, what’s likely to be new on this year’s agenda for Boards and executives to discuss?

1. Environmental, Societal and Governance (ESG) metrics

Whether it’s because of company focus on external stakeholders or pressure from activist investors, we’ve already seen a large increase in companies including ESG metrics in their incentive plans.

ESG embraces a diverse range of issues and how they are incorporated in incentive plans varies greatly not only in how they are measured but, as importantly, what is measured and how much it influences actual payouts.

For example, Environmental criteria may include meeting carbon footprint reduction targets and or increasing the percentage of renewable energy used by the organization.

Societal areas could include support for disadvantaged school systems or support for specific programs such as Science Technology Engineering and Math (STEM).

Governance can focus on a variety of areas from fostering an open culture to setting the highest standards for professional integrity which might include Diversity, Equity, and Inclusion (DE&I) objectives.

Indeed, according to Harvard Law Review, among the S&P 500 companies filing proxy statements between January and March of 2021, there was a 19% increase of companies including a DE&I metric over the prior year.

The point here is that, under the ESG umbrella, companies are still trying to figure out what is important to their shareholders and what should be (can be) measured and included as incentive metrics.

2. Human Capital Management (HCM)

The U.S. Securities and Exchange Commission (SEC) has recently introduced new disclosure requirements designed to provide stakeholders insight into an organizations HCM – from the operating model and talent planning practices through to the employee experience and work environment.

As with many other historical disclosure requirements, it is to be expected that companies will begin to mirror their HCM disclosures with some metrics included in incentive programs.

At the risk of being dilutive to other metrics incorporated into incentive plans, it can be expected that the ESG metrics will likely start to include some metrics related to their HCM.

For example, as part of an organization’s DE&I objectives, the attraction, retention, training, and promotion of diverse employees becomes a standard for measurement with incentive dollars tied to it.

3. Pay for Performance

Without doubt, this year’s executive compensation discussions will have the usual focus on pay for performance.

What will be different this year, however, is that while the economy was beginning to turn around, there are some significant headwinds companies are facing.

Talent shortages continue to be a critical business matter directly affecting companies’ ability to effectively serve their customers and to grow profitably.

And a significant downturn in the stock market has impacted shareholders’ perspective of company performance.

It has also adversely affected executive compensation currency since most long-term incentives are paid in the form of stock and/or stock options which now may be underwater.

Conclusion

How companies deal with these matters will shape how their programs are perceived both internally and externally.

It is always important to remember, whether it is a closely held family-owned business or a Fortune 100 publicly traded company, executive compensation is one of the most impactful communication vehicles a company has.

Through these programs, a company communicates what is important, how they define success, and how they value success (or lack of).

This year will be different in that people will be looking forward to the post-pandemic world, judging how the company has acted during the pandemic, and trying to assess the potential impact of the war in Ukraine.

Extra prudence is advised.

Copyright OrgShakers: The global HR consultancy for workplace transformation founded by David Fairhurst in 2020

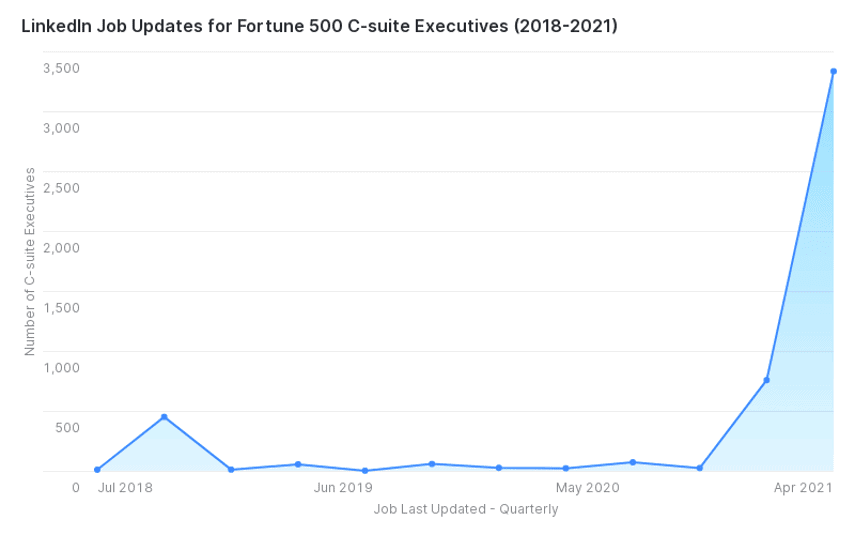

OrgShakers crack data analyst, Imogen Parsley, conducted a review of LinkedIn Updates and the results should cause significant concern in the board room.

A staggering rate of increase has occurred for C-suite executives updating their LinkedIn profiles.

Well, it is no secret that executive search firms leverage LinkedIn as one of their primary sources. Some may have done it because they’ve changed roles or employer.

But, why the sudden surge in updates? Is this a sign of the first wave of post-pandemic executive fatigue?

If this doesn’t set off significant alarm bells in the boardroom, someone is not paying attention.

Boards should take note and check to ensure the effectiveness of their total rewards and other recognition for their leadership team.

- Does the team feel recognized and appreciated by the board?

- How has the C-suite been treated throughout the pandemic?

- Does the current compensation structure provide enough reward when merited by performance?

- Are metrics reasonable or too aggressive?

- Is there enough retention value in your Long-Term Incentives?

Board’s need to take stock of their rewards and the possible risk of key C-suite departures. As importantly, they need to pay close attention to the strength of their succession plan.

The first in line may be at the highest risk of departure. This follows a trend where recent study by Monster.com showed that more than 95% of employees in the US are considering a job change post pandemic.

The C-suite is apparently not immune from that sentiment – Boards ignore at your own risk!

Similar alert for CEOs!

When was the last time you gave unsolicited feedback?

When was the last time you told one your direct reports they did a great job on something?

How realistic is your succession plan? How strong is the retention component of your executive compensation program?

Should you engage your board with some recommendations for updates/modifications to your compensation structures?

Now is the time to act, by year end your best leaders may have already taken the call.

If they take the call, they are gone.

Copyright OrgShakers: The global HR consultancy for workplace transformation founded by David Fairhurst in 2020

“If you want to get paid New York rates, you work in New York … none of this, ‘I’m in Colorado … and getting paid like I’m sitting in New York City.’ Sorry. That doesn’t work.”

This comment from Morgan Stanley CEO James Gorman during a recent investing conference created quite a commotion in the Twittersphere. And it’s likely that many Chief People Officers winced when they first heard it.

Is this evidence of a CEO who is insensitive to the reality of post-pandemic workplace dynamics?

Gorman continued: “Make no mistake about it. We do our work inside Morgan Stanley offices, and that’s where we teach, that’s where our interns learn, that’s how we develop people.”

So, was this actually an insight into the mind of a CEO who had assessed how best to meet the needs of his customers and organize work accordingly?

Either way, Gorman has highlighted that most organizations are going to be forced to re-evaluate how best to organize how work is performed, where it is performed, and who should perform it.

His comments also illustrated that most compensation structures are woefully out of date: why shouldn’t someone sitting in Colorado be paid as if they are sitting in New York? They’re doing the same work after all.

A recent study by Monster.com found that 95% of people are considering changing jobs following the pandemic – and according to the US Department of Labor a record 4-million people quit their jobs in April alone. A significant portion of employees also considering “fractional” employment where they work for more than one employer.

The pandemic is also forcing employers to re-think their real estate footprint, with a recent McKinsey survey showing that 9 out of 10 organizations are planning to combine remote and on-site working.

All of this will all lead to a different kind of workforce, delivering work in different ways, from different locations.

So, does it make sense to keep the traditional “one size fits all” approach to job structures and the associated pay?

Most of today’s compensation systems are focused on rewards for doing a specific job in a specific geography. And many of the job evaluation systems that help level and price these jobs are based on evaluation methodologies that are decades old and an assessment of values that are based on outdated workplace dynamics.

Now is, therefore, a perfect time to step back and reassess what is important to an organization, how best to structure the business to deliver the work, where talent should be located, and then – and only then – how best to reward that talent.

All too often in the past, compensation systems have been disconnected from the overall human capital strategy. Chief People Officers now have a unique opportunity to take a deeper, more strategic look at how you staff, who you staff – and how you keep them.

With extensive knowledge and expertise gained from supporting organizations of all sizes, OrgShakers can help you to positively “shake up” thinking about compensation systems to give you the reward agility you need to sustain and accelerate business performance.

Copyright OrgShakers: The global HR consultancy for workplace transformation founded by David Fairhurst in 2020